Most people in the resource business are familiar with flow-through shares – a tax incentive provided by the Federal Government and often augmented with Provincial “bump-ups” used for Canadian Exploration Expenses (CEE) and/or Canadian Development Expenses (CDE), but not everyone is familiar with charitable flow-through financings.

The governments allow the eligible exploration expenses to be “passed along” to the investor who purchases flow-through shares. The incentive has been around for decades and has helped build a number of mines in Canada and advance projects in more remote regions providing employment and skills training for a variety of people from line-cutters to engineers – virtually every expense incurred for the purpose of determining the existence, location, extent, or quality of a mineral resource qualify as CEE. CDE is available for expenses incurred for the purpose of bringing a new mine in a mineral resource in Canada into production in “reasonable commercial quantities” and for oil and gas exploratory work. The transition from CEE to CDE eligible expenses is not clear cut and some gaps exist – one is recommended to defer to their tax specialist for the final word.

Traditional flow-through financings were the standard until the introduction of charitable flow-through financings developed by PearTree’s founder, Ron Bernbaum in 2006. Traditional flow-through shares are sold by the issuer to a Canadian end-buyer, commonly a fund, which are typically held for 4 months + 1 day and utilize 100% of the issuers tax deduction. Flow-through, charitable-share financings are sold to philanthropists who remove the flow-through tax incentive and donate the (now common) shares to charity. The charity subsequently sells the common shares to end-buyers which can be based anywhere in the world. The philanthropist or donor receives an additional 50% tax deduction for the donation, while no fees are charged to the issuer or end buyer.

So, what’s best for the issuer?

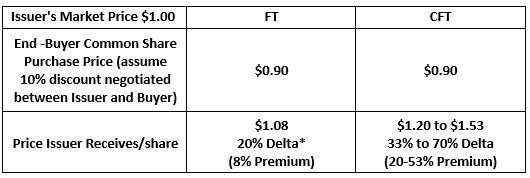

Traditional flow-through financings are usually completed at a 10-20% premium to market price with a Canadian flow-through fund being the end-buyer. A charitable flow-through financing is often done at a range of 33 to 70% above market price (assuming the end-buyer purchases the common shares at market price) depending on provincial/territorial jurisdiction. With the higher premiums available from the CFT, issuers and end-buyers often negotiate a share price below market while the issuer maintains a hefty premium. Also, because the CFT shares can be sold internationally, the end-buyers are often more supportive of the company and not just purchasing for the tax deduction advantage. This often results in less pressure after 4 months +1 day.

Example:

*Delta is the “Premium” received by the Issuer with respect to End-Buyer Purchase Price. If shares were purchased at market price, delta and premium would be the same.

What are the mechanics?

Let’s say, a FT share is bought at $1.20 and is worth $0.87 cents after four months +1 day and the buyer decides to sell the shares. For shares other than flow-through, we would have a capital loss of $0.33 ($1.20-$0.87) per share. But for flow-through shares, the starting point (or adjusted cost base) for the tax calculation is NIL, so there is a capital gain of $0.87. For an individual, half is added to income – $0.435 and about $0.22 is then to be paid in taxes for a 50% tax bracket.

The CFT combines the above with philanthropy and involves three simple steps:

- Donor buys the FT shares at $1.20

- Donor donates the shares to his/her favourite charity on the same day as issuance

- Charity immediately sells the shares to a pre-determined end-buyer for $0.87.

The charity issues a fair market receipt for what it receives in cash on closing, being $0.87. No charity – especially the big institutions such as hospitals and universities- would accept shares unless it has the ability to immediately monetize the shares. The original flow-through share subscriber, the donor, similar to above, starts with an adjusted cost base of NIL. The donor receives a fair market receipt from the charity for $0.87 per share, but also gets a 50% deduction due to the charitable contribution. This reduces the top-tax bracket individuals tax liability.

For resource issuers and institutional/strategic investors it means that a charitable flow-through issue can be placed with global institutions and strategic investors at superior prices. Again, with no fees to the issuer or the end buyer.

CFT companies aim to help charity and the exploration community. When Companies undertake Charitable Flow-Through Financings, charities benefit and when a donor’s after-tax cost of giving is lower, they give more. Just like any other commodity, if the price is lower consumers buy more.