Preliminary reports from Ministry of Energy and Mines and Petroleum Resources regional geologists and the Mineral Development Office indicate exploration activity in 2017 has improved over 2016, stabilizing a decreasing trend that started in 2012. A few projects were interrupted by forest fires, but work resumed in the fall. Activity was driven by elevated gold, base metal and coal prices.

Precious metals

Pretium Resources Inc. announced commercial production at its gold silver Brucejack mine in July and carried out a summer regional exploration program. IDM Mining Ltd. continued to advance its Red Mountain project with step-out drilling, a feasibility study, and a project application and environmental impact statement, which were submitted to regulators and stakeholders. Drilling highlights included Red Mountain’s highest-grade intersection to date: 1,400 grams per tonne gold and 437 g/t silver over 0.5 metres, in an interval of 149.24 g/t gold and 59.88 g/t silver along 4.88 metres.

GT Gold Corp. made a grassroots discovery at its Tatogga project where 11 of 58 soil samples returned assays greater than 10 g/t gold, with highs to 72.3 g/t. These results prompted a reverse-circulation drilling program, which yielded results of up to 17.41 g/t gold over 9.14 metres. Ongoing diamond drilling returned results of up to 51.53 g/t gold and 117.38 g/t silver over 6.95 metres.

In the spring, Ascot Resources Ltd. announced plans for 140,000 metres of drilling at its Premier/Dilworth project. By early September, more than 80,000 metres in 250 holes were completed. The drilling discovered a new high-grade subzone (Ben) of the Northern Lights zone in the Premier mine area. Numerous high-grade intersections were reported, including 36.31 g/t gold along 16.15 metres.

Tudor Gold Corp. reported drilling results, including 5.1 metres of 9.57 g/t gold for extensions of the GR2 zone at the Treaty Creek project. Other drilling programs in the Northwest Region included those by Auryn Resources Inc. (15,000 metres at Homestake Ridge), Jayden Resources Inc. (1,800 metres at Silver Coin) and African Queen Mines Ltd. (2,000 metres at Yellowjacket Gold).

Work continued to search for lode gold sources in the Atlin area, at the Yellowjacket Gold project, Gray Rock Resources Ltd.’s Surprise Lake project and Brixton Metals Corporation’s Atlin Gold project.

Porphyry projects

Seabridge Gold Inc. continued to obtain drilling results for the Iron Cap deposit at its KSM project. The project consists of the Kerr, Sulphurets, Mitchell and Iron Cap deposits. This year, drilling at Iron Cap produced results that include 491 metres of 0.98 g/t gold and 0.6 per cent copper. Although Iron Cap is closest to project infrastructure and is permitted as a block cave operation, which is cost-efficient, the current plan has it being mined after the Kerr deposit. Increasing the resource at Iron Cap could result in significant changes to the mine plan.

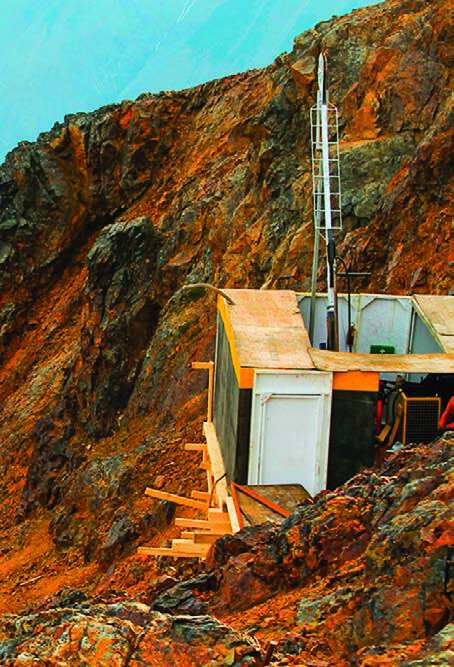

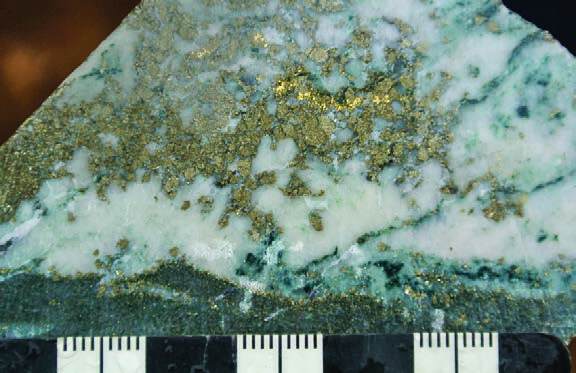

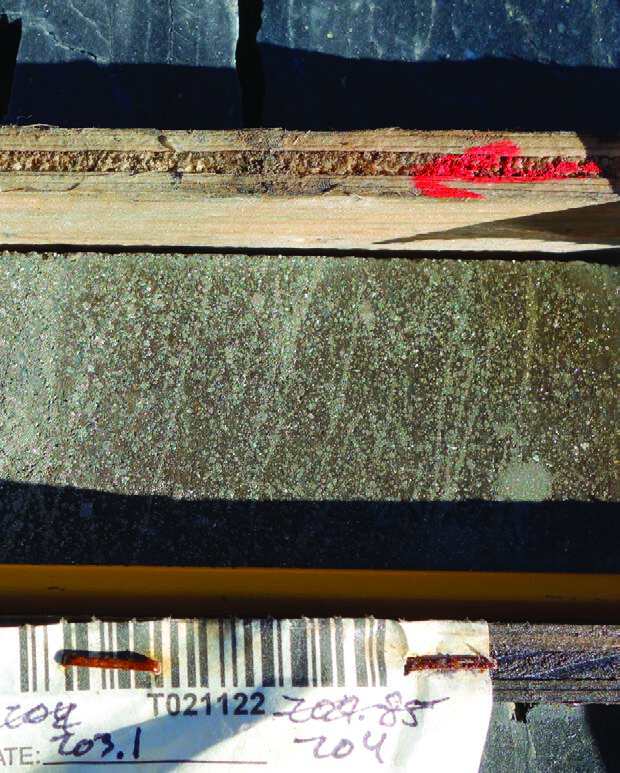

Colorado Resources Ltd. completed 8,100 metres of drilling at its KSP project, and announced the discovery of high-grade intervals with visible gold, new mineralized trends and porphyry-style gold-copper mineralization. Highlights included 4,470 g/t gold over 0.5 metres and 0.43 g/t gold and 0.11 per cent copper over 195.4 metres. A second phase of drilling was planned for the fall.

For its Thorn project, Brixton Metals Corporation announced discovering porphyry gold- and silver-related mineralization with the first-ever drilling of the Chivas zone. Highlights included 17.26 metres of 0.61 g/t gold and 110.27 g/t silver.

Skeena Resources Limited filed a mineral resource update and a preliminary economic assessment for its Spectrum-GJ project. The project consists of two deposits, separated by about 14 kilometres – one porphyry copper-gold (Donnelly, at GJ), the other porphyry gold copper (Spectrum). !

OK2 Minerals Ltd. announced the discovery of a new mineralized porphyry body at its Pyramid project during reconnaissance reverse circulation drilling. The company planned to follow up with 2,000 metres of diamond drilling.

For its Kirkham project, Metallis Resources Inc. announced that a 1,048-metre diamond drilling program intersected zones of potassic alteration featuring abundant chalcopyrite. Mapping and sampling identified several gabbroic units considered contiguous with the rocks that host nickel-copper sulphides at Garibaldi Resources Corp.’s E&L project.

In late September, Amarc Resources Ltd. announced plans for a $600,000 fall drilling program for its DUKE project.

Polymetallic base and precious metals

The Red Cliff project is a joint venture between Decade Resources Ltd. (65 per cent) and Mountain Boy Minerals Ltd. (35 per cent). In late September, initial results were reported for drilling and sampling. Highlights included drilling results of 19.9 g/t gold over 4.12 metres and chip sampling results of 390 g/t gold over five metres. Drilling was expected to continue into November.

Northwest Region (Skeena)

Aben Resources Ltd. carried out drilling on its Forrest Kerr project. In early October, results for the first of six holes were reported. The hole, a 280-metre step-out north of historical drilling, returned 10.0 metres of 6.7 g/t gold and 0.9 per cent copper.

In July, Seabridge Gold Inc. reported that sampling and geophysical programs were concluding on its Iskut project and that the results would be used to establish locations for 8,500 metres of drilling on the Quartz Rise target, which appears to be a stacked lithocap precious metals system.

In June, Desert Star Resources Ltd. announced signing an agreement to acquire 100 per cent interest in the Kutcho project from Capstone Mining Corp. for $28.8 million. In July, Desert Star announced a pre-feasibility study with updated resource figures. At a 1.0 per cent copper cut-off, combined measured and indicated resources are estimated at 16.853 million tonnes of 1.89 per cent copper, 2.87 per cent zinc, 0.36 g/t gold and 32.8 g/t silver.

Dolly Varden Silver Corporation reported drilling results for its Dolly Varden project, which consists of the Torbrit, Dolly Varden, Wolf and North Star deposits. Drilling between the Torbrit and Wolf deposits resulted in a new discovery (Central zone), with results that included 16.10 metres (13.19 metres true thickness) grading 269.0 g/t silver, 0.30 per cent lead and 0.21 per cent zinc. Followup drilling confirmed this discovery, returning results of 7.15 metres (6.72 metres true thickness) grading 1,180.7 g/t silver, 1.83 per cent lead and 0.26 per cent zinc. Based on these results, plans for drilling increased from 5,000 to 12,000 metres.

Nickel/copper projects

Garibaldi Resources Corp. reported that diamond drilling at its E&L project intersected two intervals of sulphide mineralization totalling 176 metres in a sequence of mafic and ultramafic rocks.

Coal

Allegiance Coal Limited announced a favourable pre-feasibility study for its Telkwa Metallurgical Coal project and plans for a feasibility study and permit applications.

Northeast and North Central Regions

Precious metals

New Gold Inc. continued advancing its environmental assessment process for its Blackwater gold project, anticipating approval in 2017, and undertook geotechnical work related to mine design. Proven and probable reserves stand at 8.2 million ounces gold and 60.8 million ounces silver. As proposed, Blackwater would be a 60,000-tonnes-per day operation with a 17-year mine life.

Independence Gold Corp. completed a mobile metal ions (MMI) soil survey on its 3Ts property, and identified new exploration targets. Joe Hirak drilled on his Prophecy project near Manson Creek, following up on a vein discovery of galena with gold. Gitennes Exploration Inc. continued work on its Hixon and Snowbird properties with ground magnetic surveys, mapping and sampling. In September, Tower Resources Ltd. announced plans for drilling on its Nechako Gold project beginning in mid-October.

Porphyry projects

AuRico Metals Inc. completed 12,000 metres of drilling to infill and extend its deposit at Kemess East (KE). At Kemess Underground (KUG), AuRico continued engineering studies to evaluate whether development could be integrated with KE. An environmental certificate was issued for KUG in April, and in early September the company made an application for KUG to the Major Mines Permitting Office. It also produced an NI 43-101 report for both projects in July.

The former Kemess South (KS) mine closed in 2011. However, KS infrastructure remains in place, and both camp and ore processing plant would be used to service the newly developed mines. KUG is about 6.5 kilometres north of the KS processing plant, and KE is about one kilometre east of KUG. KUG is considered a stand-alone operation for permitting purposes, to be mined by panel caving, with crushed ore conveyed underground to the processing plant. KE is also being treated as a stand-alone underground operation, but would use facilities developed for KUG. KUG has an estimated 246.4 million tonnes of indicated resource, with 1.195 million pounds copper, 3.3 million ounces gold and 13.9 million ounces silver. Within this resource are probable reserves of 107.4 million tonnes containing 629.6 million pounds copper, 1.9 million ounces gold and 6.7 million ounces silver. KE is estimated to contain an indicated resource of 113 million tonnes containing 954 million pounds copper, 1.7 million ounces gold and 7.1 million ounces silver.

In March 2017, AuRico acquired Kiska Metals Corp. and entered into an agreement with First Quantum Minerals Ltd. to explore the Kliyul property in 2017, by a 40-line-km induced polarization (IP) survey.

Centerra Gold began an on-lease exploration program at its Mt. Milligan mine. The program, designed to extend the ore body, included 6,812 metres of drilling near the open pit and 280 line-km of ground magnetics on 100-metre spacings south and southwest of the open pit.

In April 2017, Serengeti Resources Inc. released an NI 43-101 report on its Kwanika property. The Kwanika porphyry deposit consists of the Central and South zones, which Serengeti has been exploring for more than a decade. The report proposes an integrated open-pit and underground (block caving) Central zone mine, with a life of 15 years at 15,000 tonnes per day. The Central zone has an indicated resource of 101.5 million tonnes accessible by open pit, containing 697 million pounds copper, 1.04 million ounces gold and 3.1 million ounces silver; and a further 29.7 million tonnes accessible by underground mining, containing 222.3 million pounds copper, 350,000 ounces gold and 1.0 million ounces silver. The South zone has an inferred resource of 33.3 million tonnes accessible by open pit, containing 191.4 million pounds copper, 90,000 ounces gold and 1.7 million ounces silver. In early October, Serengeti announced that it reached an agreement with Daewoo Minerals Canada (DMC) in which DMC would contribute its five per cent interest in Serengeti and $7 million and Serengeti would contribute the balance of its interest to a new joint venture company, the Kwanika Copper Corporation (65 per cent Serengeti, 35 per cent DMC).

Along with its joint venture partner, Fjordland Exploration Inc., Serengeti completed a three-hole, 1,200-metre drill program to test a strong IP anomaly on its Milligan West property. Serengeti also completed a three-hole, 1,140-metre program nearby, on its UDS property.

Amarc Resources Ltd. acquired the right to purchase 100 per cent of Cascadero Copper’s and Gold Fields Toodoggone Exploration Corporation’s PINE property near its JOY property, and completed a farm-in agreement with Hudbay Minerals Inc. on the JOY property. Under this agreement, Hudbay committed to a multi-year drilling program by the end of 2020, with Amarc as the operator. Drilling on JOY began in August; assay results were expected in November.

Pacific Empire Minerals Corp. completed a five-hole, 1,080-metre drilling program on its Pinnacle Reef (formerly Later) property. Lorraine Copper Corp. optioned its Lustdust property to 1124245 BC Ltd., which conducted a 40-line-km IP program and about 500 metres of drilling in three holes. MGX Minerals Inc. planned five 150-metre boreholes on its Fran copper-gold porphyry project.

Polymetallic base and precious metals

Canada Zinc Metals Corp. completed an eight-hole, 4,700-metre drill program at its Cardiac Creek deposit in its Akie project area, aimed at extending the resource. The company commissioned a structural interpretation of satellite imagery over its properties. The interpretation identified predominantly northeast-vergent thrust faults, except for a zone along the eastern margin of the area with structures that verge southwest, and major transverse faults. Forty one new exploration targets were identified.

Specialty metals and industrial minerals

Arctic Star Exploration Corp. completed four boreholes on its CAP claims, targeting coincident geophysical anomalies suspected of being related to a carbonatite. A carbonatite discovered in outcrop has a strike length of about three kilometres (as indicated by a single borehole) and a thickness of at least 50 metres. Significant niobium pentoxide and total rare earth oxide (TREO) concentrations were encountered in both grab samples and drill core. In the borehole, this included about 10.5 metres grading 0.35 per cent niobium pentoxide, 19.5 metres grading 9.94 per cent phosphorous pentoxide, and 2.4 metres grading 0.81 per cent TREO.

Taseko Mines Ltd. proposes an open-pit mine at its Aley niobium bearing carbonatite project, and the permitting process is ongoing. The mine would process 10,000 tonnes per day and produce ferroniobium.

FPX Nickel Corp. (formerly First Point Minerals) continued to explore the Decar nickel deposit where mineralized serpentinite contains awaruite, a nickel alloy mineral. The company completed 1,917 metres of drilling in eight boreholes, extending the richest zone by 500 metres. Decar is a low-grade deposit that, if developed, would be among the largest nickel mines in the world.

The environmental assessment review for Graymont Western Canada’s Giscome lime production project is in place, and the Mines Act permit process is underway. Initially, up to 600,000 tonnes of limestone would be quarried annually, with the crushed stone moved by conveyor to vertical lime kilns near Giscome, and the product transported by existing rail lines to service mining and pulp and paper operations in northern B.C.

Fertoz International Inc. continued progress on its Mines Act permit for the Wapiti phosphate project in northeastern B.C. The permit would allow a seasonal, shallow, open-pit mine, with a 20-year life, producing up to 75,000 tonnes of phosphate per year for organic agriculture. In 2017, the company focused on completing infrastructure.

MGX Minerals Inc., in partnership with Electra Stone Ltd. and Zimtu Capital Corp., drilled nine holes at 50-metre intervals on its Longworth project, exploring a near-surface, high-purity silica target in orthoquartzites. Four silicon dioxide zones were identified along a 7,000-metre strike length.

Green Mountain Jade Inc. continued exploration and mining for jade at Ogden Mountain.

Coal

Colonial Coal International Corp. explored for coal at depth by drilling four holes at 1,800-metre centres on its Flatbed project in the Gates Formation near the Trend Mine (now on care and maintenance). Drilling encountered flat-lying coal units at depths of 700 metres that, if developed, would be mined underground.

Atrum Coal NL extracted anthracite samples from its Groundhog deposit for testing in North Asian steel mills. Environmental baseline studies continued, but a bulk sample permit application was put on hold. Nearby, at the Panorama project, Atrum drilled five boreholes totalling 1,228 metres and conducted mapping that identified coal seams at surface.

Southeast Region

Precious metals

KG Exploration Inc. (Kinross Gold Corporation) continued exploring for skarn, volcanogenic massive sulphide (VMS) and epithermal mineralization on 27,346 hectares optioned from Grizzly Discoveries Inc., and drilled at the Midway and Mt. Attwood claims. The land package is just north of the company’s Kettle River operations in Washington State, which has a mill capacity of 1,800 tonnes per day. Also in the Greenwood mining camp, Golden Dawn Minerals Inc. signed a letter of intent to acquire assets owned by Kettle River Resources Ltd., which include a large land package and numerous past-producing mines. The package complements the company’s 2016 acquisition of the Lexington mill (200 to 400 tonnes per day) from Huakan International Mining Inc. It drilled at its May Mac and Golden Crown projects, and began dewatering the historic Lexington mine and upgrading the mill. GGX Gold Corp. drilled and trenched at its Gold Drop property, targeting epithermal-style veins.

In the West Kootenays, Margaux Resources drilled at its Bayonne project, targeting a past-producing vein system, and conducted grassroots mapping and sampling on its other properties in the Sheep Creek Gold camp. Prize Mining Corporation entered into an option agreement with Apex Resources Inc. to gain an interest in approximately 8,000 hectares, and began sampling on properties near the Daylight (Kena) project to prioritize targets for drilling late in the year. Valterra Resource Corporation followed up on mapping and soil sampling with drilling at the Swift-Katie project, targeting a gold vein system associated with an alkali porphyry.

In the East Kootenays, PJX Resources Inc. continued exploring at the Dewdney Trail project, following up on stream-sediment samples anomalous in gold. It also continued mapping and sampling near geochemical anomalies at its Zinger property to identify targets for drilling.

Polymetallic base and precious metals

SEDEX and associated polymetallic mineralization in Mesoproterozoic rocks continued to be targets in the East Kootenays. PJX Resources Inc. continued geophysical work and drilling at the Vine property. At the Irishman project, Teck Resources Limited conducted geophysical surveys to better delineate targets, and Highway 50 Gold Corp. continued drilling at its Monroe property, offsetting lead-zinc mineralization it identified in previous drilling. Eagle Plains Resources Ltd. conducted ground IP geophysics on its Iron Range project, and mapping and sampling at its Vulcan project. On the eastern margin of the Rocky Mountain Trench, Kootenay Zinc Corp. drilled at the Sully property, targeting magnetic and gravity anomalies in overturned structures within the Aldridge formation.

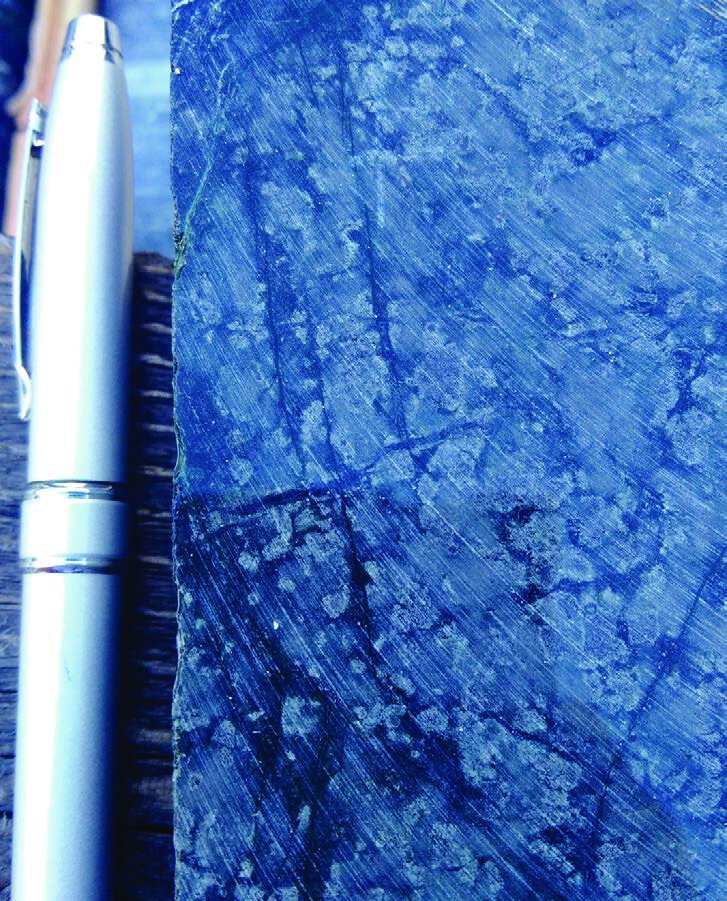

North of the Canada-U.S. border, Antofagasta plc optioned more than 21,000 hectares owned by Kootenay Silver Inc. and drilled at the Silverfox property. It is exploring the northern extension of the productive western Montana copper belt, where copper-silver mineralization is in Proterozoic sedimentary rocks.

In the West Kootenays, Taranis Resources Inc. continued exploring the Thor property, which has several gold and stratiform base metal targets. It produced a gold concentrate with a portable test mill for metallurgical testing, and is planning additional drilling to extend the deposit. Klondike Silver Corp. continued exploring its Silvana project, and is developing a 3D model of vein systems that were mined near Sandon to identify additional potential targets. Braveheart Resources Inc. drilled at the Alpine property, targeting a gold- and silver-bearing vein system.

Along the Kootenay Arc, Rokmaster Resources Corp. compiled historical data and drilled at its Duncan project for stratiform replacement zinc-lead, targeting historic grades of six to 10 per cent combined. Margaux Resources Ltd. targeted the gold zone at the Jersey-Emerald project in drilling, and is working on a preliminary economic assessment to reprocess the historical mine tailings for tungsten. The company also drilled at its Jackpot project for stratiform zinc-lead, and conducted additional grassroots exploration and sampling along trend.

Specialty metals and industrial minerals

CertainTeed Gypsum Canada Inc. continued to advance the proposed Kootenay West mine, which entered environmental assessment in March 2017. The company made an application to temporarily suspend the 180-day review period to submit additional technical information, and to respond to comments received by the Environmental Assessment Office, the working group and First Nations. The mine will replace the company’s gypsum production after economic reserves of the Elkhorn mine are depleted.

Baymag Inc. conducted exploration near its Mount Brussilof mine, and MGX Minerals Inc. continued moving its Driftwood Magnesite project forward, with bulk sampling and drilling. MGX has acquired a mining lease for a quarry operation, and is moving toward a preliminary economic assessment.

Voyageur Industrial Minerals Ltd. drilled at Frances Creek, targeting a barite breccia vein that it hopes extends along strike. Heemskirk Canada Limited continued construction on its processing plant, which will allow the company to redevelop the Moberley Silica mine into a frac sand operation, and HiTest Sand Inc. continued work at the Horse Creek Silica quarry.

Eagle Graphite Incorporated continued work at the Black Crystal flake graphite project, with efforts on improving processing techniques to enhance the quality of the product and targeting markets for graphene. Near Grand Forks, Roxul Inc. continued production from its Winner and North Fork quarries for raw materials used at its rock wool plant.

Coal

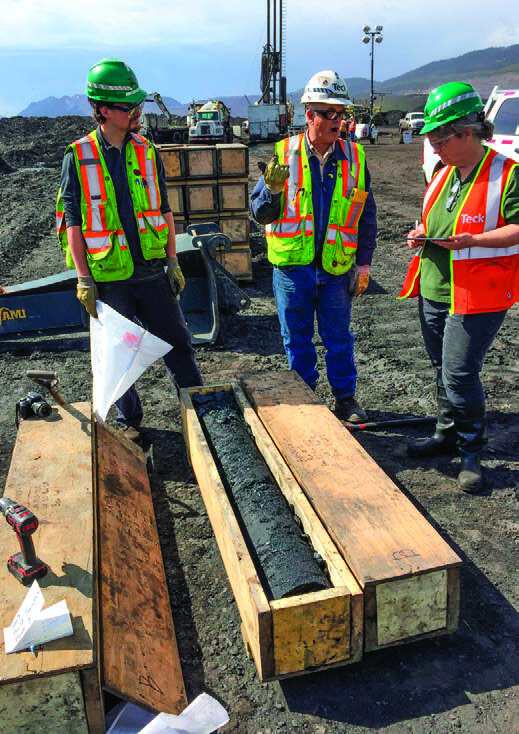

Mining operations, coal production and environmental assessment for expansion plans continue at the five mines in the Elk Valley operated by Teck Coal Ltd. The main product is metallurgical coal (85 per cent), with some thermal and pulverized coal injection (PCI) coal (15 per cent combined). Production in 2016 was 27.6 megatonnes of clean coal, with record annual production at Elkview and Line Creek, and similar volumes are expected for 2017.

At Fording River, the Swift project expansion received environmental assessment approval in September 2015.

Southeast Region

Exploration drilling continued in active pits, and coal quality testing is underway on several seams in the Swift expansion. At Greenhills, exploration drilling was focused on the Cougar pit, and the Fording Swift project is being amended to include portions of the Cougar north spoil area.

At Elkview, exploration drilling was carried out to help plan for the next phases of mine expansion in the Baldy and Natal pits. Exploration and development work continued on the approved Phase II expansion area at Line Creek, which extends the current Burnt Ridge South pit to the north.

Coal Mountain continued to operate through 2017 to develop the remaining reserves, pushing back the expected mine shut-down date to early in 2018. Teck Coal Ltd. plans to make up production losses by optimizing and increasing production at its other four operating mines in the Elk Valley.

Several other coal projects are in stages of environmental assessment. CanAus Coal Ltd. continued drilling and coal quality testing on potential expansion areas at its Loop Ridge (Michel Creek) project, which entered pre-application stages of environmental assessment in 2015. Jameson Resources Limited began preliminary engineering design work and continued environmental baseline work on its Crown Mountain project, which entered pre-application of environmental assessment in October 2014. The Bingay Main project is also in pre-application stages of environmental assessment. Centermount Coal Ltd. submitted an updated project description and consultation plan for a proposed open pit that would produce approximately one megatonne per year for an estimated 15-year life.

Pacific American Coal Ltd. began early-stage exploration and sampling work, and conducted environmental baseline and wildlife studies for planned drilling at its Elko project.

South Central Region

Precious metals

Barkerville Gold Mines Ltd.’s Cariboo Gold Project is a contender for the largest exploration program in the province, with plans to drill up to 160,000 metres in 2017. Drilling was focused on the Island Mountain area, the site of the former Aurum and Mosquito Creek mines, and northwest of the Cow Mountain and Barkerville Mountain target areas. Barkerville reported high-grade gold intersections, particularly at the Shaft zone (e.g., 20.53 g/t over 11.6 metres, 72.23 g/t over 12.05 metres, 17.45 g/t over 8.6 metres, 53.26 g/t over 11.55 metres). Work is ongoing on other parts of the project, including the BC Vein and underground development at Bonanza Ledge. Elsewhere, regional exploration has generated about 130 targets.

Eureka Resources Inc. drilled three holes totalling 331 metres at its Gold Creek project. The best results included 33.20 g/t gold over 1.25 metres and 17.95 g/t over 1.5 metres. Also in the Cariboo, Spanish Mountain Gold Ltd. updated its preliminary economic assessment at Spanish Mountain. The new study focuses on a higher-grade central area, the First zone. It proposes a 20,000-tonne-per-day throughput producing about 2.2 million ounces gold for 24 years, revising a 2012 estimate of 40,000 tonnes per day.

Westkam Gold Corp. continues underground bulk sampling and drilling to test gold-bearing veins at the Bonaparte project. Westkam amended its permit to include additional dewatering to complete the work. At the Brett epithermal gold project, Ximen Mining Corp. continued to sample core from 2016 drilling and reported high-grade gold intersections (e.g., 16 g/t over 0.39 metres, 7.23 g/t over 0.58 metres, 6.04 g/t over 0.40 metres).

In the Spences Bridge gold belt, Westhaven Ventures Inc. conducted surface programs on its recently acquired Skoonka Creek and Shovelnose properties. Work included ground magnetics, mapping, soil sampling and drilling at Shovelnose. Pending geophysical results and permits, the company plans to drill at Skoonka Creek.

In the Bridge River camp, Avino Silver and Gold Mines Ltd. is planning a surface and underground program at Bralorne, including underground exploration drilling above and below the 800 level as it considers a mine expansion. Pending permits, it plans to resume mining at an initial rate of 100 tonnes per day.

Blackstone Minerals Ltd. optioned the Little Gem project and discovered a cobalt-gold showing (Roxey) during a due diligence property examination. A fall program includes drilling and underground channel sampling.

Porphyry

At the Cariboo Region mines, Taseko has a permit to drill Gibraltar North, northwest of its current mining operations. At Mount Polley, Imperial Metals Corporation reported results of underground drilling beneath the Wight pit. To the south near Horsefly, Consolidated Woodjam Copper Corp. reported discovering copper-silver gold mineralization at surface, near the northern boundary of the Woodjam property. The company is planning an IP survey.

Highland Valley Copper Partnership (Teck Resources Limited) planned drilling, expected to start in 2017, between the Highmont and Lornex pits and an area (Athena) several kilometres east of current mining operations.

At New Afton, New Gold Inc. completed a final round of infill drilling at the C zone and tested several on-lease surface targets. The C zone resource estimate is to be updated.

Mine-evaluation-stage porphyry projects include Ajax (KGHM Ajax Mining Inc.), which is awaiting a decision on environmental certification, and New Prosperity (Taseko Mines Limited), which is the subject of litigation.

South of Merritt, Evrim Resources Corp. acquired the Axe copper-gold porphyry prospect and completed the first phase of its exploration program, including logging existing core, reprocessing geophysical data, and other data review. Tower Resources Ltd. reported results of step-out holes from drilling at Rabbit North, a copper-gold prospect. One 247-metre interval returned 0.51 per cent copper and 0.34 g/t gold. Further drilling was scheduled for October. Sego Resources Inc. obtained a permit to drill its Miner Mountain project, and planned to proceed with two to four holes in October. Wealth Minerals Ltd. optioned the Jesse Creek property in 2016 and targeted porphyry mineralization in the Nicola Group with drilling in 2017. Historical work in the area targeted skarn mineralization like that at Craigmont.

Seven Devils Exploration Ltd. drilled at the Copper Canyon property, a porphyry copper-silver-gold prospect in Spences Bridge Group rocks. Copper Mountain Mining Corporation resumed exploration at the Copper Mountain copper-gold mine site to extend Pit 2 westward and test mineralization below the pit with 8,900 metres of drilling. The company is planning for 5,000 metres of exploration drilling at the New Ingerbelle deposit. Happy Creek Minerals drilled 1,764 metres in six holes at its Rateria project, expanding Zone 2 southward with a 105.5-metre intersection of 0.37 per cent copper and 0.14 g/t gold. Amarc Resources Ltd. has completed the site component of a $3.3-million program at IKE (copper-molybdenum, silver).

Skarn

Engold Mines Ltd. announced a discovery at its Lac La Hache project in early 2017, with an intersection drilled in a gravity anomaly of 1.76 per cent copper, 0.27 g/t gold, 10.29 g/t silver and 35.8 per cent iron over 26.57 metres. Followup drilling was interrupted by forest fires, but resumed in September with a planned 10,000 metres.

Happy Creek Minerals planned 5,000 metres of drilling at the Fox tungsten project, following up on a 2016 resource update of 486,000 tonnes 0.817 per cent tungsten trioxide indicated and 361,000 tonnes 1.568 per cent inferred. The 2017 drilling is to expand the resource in advance of work toward a preliminary economic assessment.

New Craigmont is Nicola Mining Inc.’s new name for the Thule Copper project at the site of the former Craigmont Mine near Merritt. Work in 2017 included an IP survey designed to confirm and expand an earlier survey, reverse-circulation drilling to test stockpiles of historically mined material at the site (including an estimated 80 to 90 megatonnes), and exploration drilling at the Embayment and Titan Queen zones.

VMS and SEDEX

Eagle Plains Resources Ltd. is doing mapping and soil geochemistry at Acacia (zinc-lead-silver) following a compilation of historical data. Troymet Exploration Corp. carried out a test gravity survey at its Redhill zinc-copper-gold-silver project and reported several anomalies for followup. Imperial Metals Corporation’s Ruddock Creek zinc-lead-silver project remains in the pre-application stage of environmental assessment. The Harper Creek project of Yellowhead Mining Inc. is on care and maintenance and is paused in the review phase of environmental assessment.

Specialty metals and industrial minerals

Commerce Resources Corporation has an agreement to test a one-tonne sample of Upper Fir niobium-tantalum deposit material from its Blue River property. Zeolite programs active in 2017 include the Z-1 quarry and area prospects (ZMM Canada Minerals Corp.) and Bromley Creek (Canadian Zeolite Corp.).

Southwest Region

Precious metals

Following surface drilling in 2016, New Carolin Gold Corp. rehabilitated underground access for drilling at Ladner Gold, the completion of which is pending additional financing. Surespan Gold Ltd. acquired a block of Crown grants covering the Privateer mine near Zeballos and began 2,400 metres of surface drilling. Since the 1930s, the Zeballos camp produced 300,000 ounces of gold from veins. The last significant exploration effort was in the early 2000s. Approximately 20 kilometres to the southwest, Caisey Harlingten is permitted for up to 1,000 metres drilling in 20 holes using a Winkie drill at the Eliza gold-bearing quartz vein prospect. In 1940, 12.7 tonnes yielded 435 grams of gold, 93 grams of silver and 10 kilograms of copper.

Porphyry

NorthIsle Copper and Gold Inc. drilled its North Island Project at Red Dog and Hushamu, which are adjacent porphyry copper-gold-molybdenum prospects that are the subject of a new preliminary economic assessment. The new assessment considered a 75,000-tonne-per-day open-pit operation and estimated a base-case net present value of $550.4 million at an eight per cent after-tax discount rate. Internal rate of return is estimated at 14.3 per cent with a 22-year mine life. Two pits would be mined concurrently, with the smaller Red Dog initially providing higher-grade ore with a lower stripping ratio.

Polymetallic base and precious metals

Planning to ramp up to full production in 2018, Nyrstar NV is investing 70 million euros (C$104 million) in Myra Falls, which suspended production and exploration in 2015. The new investment will include exploration.

Coal

No coal exploration was reported in the first three quarters of 2017. However, Quinsam coal mine is resuming production. The new owner of Quinsam Coal Corporation is ERP Federal Mining Complex LLC. Quinsam now shares a parent company with Conuma Coal Resources Limited, which reopened mines in northeastern B.C.

Industrial minerals and aggregates

Exploration for aggregates and industrial minerals is commonly not reported publicly, and most construction aggregate Notices of Work (approximately 40) received by the Ministry are for mining-scale extraction. Polaris Materials Corporation, operator of the Orca quarry near Port McNeill, is considering developing a new operation (Black Bear) four kilometres from Orca that would produce crushed basalt. Vulcan Materials Company is proposing a purchase of Polaris.

Burnco Rock Products Ltd.’s Burnco Aggregate project at Howe Sound remains in the review phase of environmental assessment. Garibaldi Pumice Ltd. renewed its permit for exploration near its seasonal mine north of Pemberton. Near Tahsis, Callache Stone Quarries Inc. continues to develop a marble quarry (Tahsis). East of Chilliwack, Inua Studio is investigating a potential jade and slate quarry.

Public Geoscience 2017-2018

The British Columbia Geological Survey (BCGS) is British Columbia’s oldest science agency. Since 1895, the BCGS has created new geoscience knowledge, linking government, the minerals industry and British Columbians to the geology and mineral wealth of the province. This work continues today. BCGS geoscientists regularly publish the results of their work in government reports and maps that are freely available through MapPlace, the BCGS database driven web service, the most recent version of which was released in 2017. MapPlace 2 replaces the original version, which served the province for 20 years. It allows anyone with an internet connection to efficiently mine multiple geoscience databases, conduct queries and generate custom results from more than 130 years of geological information.

BCGS undertakes targeted and long-term geoscience projects aimed at refining British Columbia’s geological framework, increasing exploration efficiency and archiving geoscience information to advance projects without duplicating previous work. The BCGS levers its resources by partnering with federal, provincial and territorial governments, and other national and international organizations.

In 2017, field projects focused on the northwestern part of British Columbia, in the famed Golden Triangle. Mapping continued in the Atlin and Dease Lake areas, collaborating with the Geological Survey of Canada (GSC) under the second iteration of the Geo-mapping for Energy and Minerals (GEM) program.

A joint BCGS-GSC-Geological Survey of Japan collaboration is investigating specialty metals under the Targeted Geoscience Initiative (TGI4) program. Another project is directed at understanding the Upper Fir rare earth element deposit, near Blue River, that will be featured in a field trip at the Resources for Future Generations conference being held in Vancouver in June 2018. Also as part of the TGI4, BCGS has partnered with the GSC to assess gold deposits near the Llewellyn fault in B.C. and its possible extension with the Tally Ho shear zone in Yukon.

BCGS, Geoscience BC and the Mineral Deposit Research Unit at the University of British Columbia are working to deliver a new geological map near Terrace, part of the Search project area. Multi-year studies to unravel the architecture of the Nicola arc (Quesnel terrane) continue in central B.C. These rocks host some of B.C.’s most prolific porphyry deposits. Other studies examined nickel, copper and platinum-group element (PGE) reforming processes in mafic-ultramafic systems at Tulameen, and mapping of the Trembleur ultramafic rocks of Cache Creek terrane, host to the nickel-iron-alloy-bearing awaruite at the Decar property. Other projects are developing new exploration methods, emphasizing indicator minerals from till.

Each year in November, the results of BCGS programs are presented at an open house held in Victoria.

All BCGS databases are available through MapPlace 2. MINFILE documents more than 14,600 metallic mineral, industrial mineral and coal occurrences. ARIS has over 35,600 mineral exploration reports representing about $2.5 billion of reported exploration expenditures. Property File now has more than 65,500 reports and maps, documenting exploration activity in British Columbia since the late 1800s. B.C.’s lithogeochemical (nearly 11,000 samples), till geochemical (nearly 10,500 samples) and regional geochemical (nearly 65,000 samples with about five million determinations) survey databases were updated in 2017. The province-wide bedrock compilation map (BC Digital Geology) saw substantial updates and a refined labelling and colour scheme.

In addition to the BCGS and the GSC, Geoscience BC – a not-for-profit, non-government geoscience organization funded by provincial government grants – provides geoscience in British Columbia. Geoscience BC awards contracts for large geophysical and geochemical programs and provides grants to universities and consultants for targeted geoscience projects, typically generated through requests for proposals.