Petroleum Resources Mineral Development Office (British]() Preliminary reports from the Ministry of Energy, Mines and Columbia Geological Survey) and regional geologists suggest that exploration activity has declined slightly in 2019 after a recovery that started in 2017. Despite this, a number of companies reported new discoveries and significant results.

Precious metal projects

Ascot Resources Ltd. acquired IDM Mining Ltd. and its Red Mountain project. At its Premier project, Ascot continued to drill at the past producing Premier mine and the Big Missouri and the Northern Lights zones. As well, the company drilled at its nearby Silver Coin project. As of early October, more than 50,000 m of drilling had been carried out on these projects. Results included 24.45 g/t Au across 8.43 m, including 150 g/t Au across 1.0 m at Premier, 56.80 g/t Au across 1.65 m at Big Missouri, 9.41 g/t Au across 2.45 m at Northern Lights, and 11.44 g/t Au across 6.00 m at Silver Coin.

Skeena Resources Limited announced in August that a phase one 15,000 m drill program was underway at its Eskay Creek project. Reported results included 17.93 g/t Au and 15 g/t Ag across 22.65 m and 27.37 g/t Au and 18 g/t Ag across 9.4 m.

At its KSM project, Seabridge Gold Inc. planned 4,000 m of drilling to test high-grade gold targets at the Sulphurets deposit. High-grade epithermal gold mineralization was discovered in 2018 during waste characterization and geotechnical drilling for the proposed Sulphurets pit.

Brixton Metals Corporation carried out a 1,992 line km helicopter borne magnetic survey, soil sampling, and rock sampling, and drilled 1,618 m at its Atlin Goldfield project. Gold mineralization was intersected in 13 of 22 holes. Results included 8.53 g/t Au across 2.0 m at the LD showing and 3.6 g/t Au across 1.0 m at the Pictou showing.

Margaux Resources Ltd. acquired the Cassiar Gold project from Wildsky Resources Inc. The project contains two historic resources, Taurus and Table Mountain. Margaux carried out a review of historic drilling and announced a mineral resource estimate in the Inferred category of 21,830,000 t grading 1.43 g/t Au at a 0.7 g/t Au cut-off for the Taurus deposit.

Sky Gold Corp. drilled a total of 811 m in six holes on the Clone Gold project. Highlight results included 8.57 g/t Au and 1.06 g/t Ag across 5 m, 124.6 g/t Au and 5.6 g/t Ag across 4.1 m, and 0.63 g/t Au and 474 g/t Ag across 2 m.

Tudor Gold Corp. reported drilling results for its Treaty Creek project. Highlights from the Goldstorm zone included 1081.5 m averaging 0.589 g/t Au including an upper interval of 301 m containing 0.828 g/t Au. American Creek Resources Ltd. has a 20 per cent carried interest in the project.

Drilling results from more than 10,000 m of drilling at Aben Resources Ltd.’s Forest Kerr project continued to expand the mineralized area of the North Boundary zone. Highlights include a 16 m interval that averaged 2.22 g/t Au, 2.39 g/t Ag and 3050 ppm Cu. In this zone are two separate 1 m high-grade intervals. One yielded 19.85 g/t Au, 9.10 g/t Ag, and 6810 ppm Cu, and the other 11.30 g/t Au, 8.70 g/t Ag, and 14,200 ppm Cu. Base and precious metal mineralization has now been defined across an area of more than 600 m by 250 m.

Mapping, geophysics, trenching, and rock and soil sampling carried out by Metallis Resources Inc. on its Kirkham property outlined a strongly altered 1,000 m long by 300 m wide zone of northeast-trending faults that appear to control highgrade gold-bearing quartz sulphide veins. These veins were the target of a phase one 4,000 m drilling program.

Crystal Lake Mining Corporation’s Newmont Lake project has both precious metal and porphyry targets. Drilling at the Lake Gold Corridor target returned 15.11 g/t Au across 8.0 m.

Engineer Gold Mines Ltd. began a planned 3,000 m of drilling at the Engineer Gold Mine project. Dewatering of historic workings continued, which will allow access for planned underground exploration, development, test mining and bulk sampling.

Libero Copper & Gold Corporation carried out soil sampling, rock chip sampling and geologic mapping at the Big Red property. A single continuous 50 m chip sample at the Ridge gold target assayed 5.14 g/t. At the Copper Bowl target, five contiguous 50 m continuous rock chip samples returned 2.91 g/t across 250 m.

StrikePoint Gold Inc. carried out approximately 2,000 m of drilling at its Willoughby project. Initial assay results for the Wilby zone included 3.87 g/t Au across 11.7 m. Results for a 100 m step-out from the North zone returned 26.28 g/t Au and 95 g/t Ag across 4.0 m. Within this was a 1.0 m high-grade interval assaying 102 g/t Au and 356 g/t Ag.

Scottie Resources Corp. announced that a phase one drilling program of 2,000 m was to be split between its Scottie Gold Mine and Bow properties.

Cu-Mo, Cu-Au-Ag, Mo (porphyry) projects

GT Gold Corp. announced a $17.6-million financing by Newmont Goldcorp Corporation for exploration for the Tatogga project. A phase one 8,652 m drilling program at the Saddle North target continued to return good results, including 0.55 per cent Cu, 0.91 g/t Au, and 1.34 g/t Ag across 500 m. Phase one was followed by a phase two 15,000 m program in the fall.

Golden Ridge Resources Ltd. carried out drilling on its Hank and Ball Creek projects. At Hank, broad intervals of copper-gold mineralization continued to be intersected. Reported assays included 0.35 per cent Cu, 0.28 g/t Au, and 1.71 g/t Ag across 278 m within 380.5 m of 0.28 per cent Cu, 0.22 g/t Au and 1.43 g/t Ag. The Ball Creek project was optioned from Evrim Resources Corp. in July and Golden Ridge also carried out prospecting and mapping programs.

Goliath Resources Ltd. drilled 1,741 m in three holes at the Lucky Strike project. Drilling intersected the newly discovered Lorne Creek porphyry. All holes intersected sulphide mineralization from surface to end of hole.

Galore Creek Mining Corporation is a 50/50 partnership between Newmont Mining Corporation and Teck Resources Limited. In 2019 the company began a three- to four-year commitment for the Galore Creek project to complete a prefeasibility study to better understand it overall. In 2019, the focus was on advancing project knowledge in the areas of access and infrastructure, exploration, geoscience, resource modelling, geotechnical engineering, geohazard mapping, metallurgy, mine planning, Tahltan knowledge and land use, archaeology, and water and environmental baselines.

Hudbay Minerals Inc. relinquished its option on the Hat project with Doubleview Capital Corp. Doubleview used the results of a 40 line km, deep-penetrating IP survey carried out in 2018 by Hudbay to help select targets for a fall drilling program.

Brixton Metals Corporation carried out two phases of drilling at its Thorn project. The first phase was a 829 m hole drilled to test the Oban zone at depth. The hole returned 554.7 m grading 0.24 per cent Cu, 0.57 g/t Au, 43.18 g/t Ag, 0.55 per cent Zn and 0.28 per cent Pb. A follow-up program of 7,000 to 10,000 m was planned for the fall along with a 25 line-km Titan DCIP and magnetotelluric survey.

Colorado Resources Ltd. carried out a high-resolution airborne survey, ground IP surveys, soil sampling and prospecting at its Castle property. Drilling 1,500 m in four holes commenced in the fall. The target is geologically and geophysically similar to GT Gold Corp.’s Saddle North deposit 5 km to the east.

Universal Copper announced an initial 511 m vertical hole at its Poplar property assayed 0.413 per cent Cu, 0.013 per cent Mo, 0.12 g/t Au and 2.27 g/t Ag over 394.82 m. At the Berg project, Centerra Gold Inc. drilled 740 m in two holes.

Crystal Lake Mining Corporation’s Newmont Lake project has both precious metal and porphyry targets. Drilling results for the Burgundy Ridge porphyry target returned 0.45 per cent Cu, 0.33 g/t Au, and 3.44 g/t Ag across 56.35 m. The drilling was 2.3 km northeast of mineralization at Burgundy Ridge and 250 m from historic high-grade Cu-Au skarn-type mineralization.

Hawkeye Gold & Diamonds Inc. carried out a 15 line km induced polarization survey and drilled a chargeability target defined by the survey at the McBride project.

Base and precious metal projects

Dolly Varden Silver Corporation continued to drill at its Dolly Varden project with a planned 10,000 m of drilling. Reported results for the Chance Target area included 385.4 g/t Ag, 0.24 per cent Pb, and 0.09 per cent Zn across 24.9 m (estimated true thickness), and 488.3 g/t Ag, 0.55 per cent Pb, and 0.05 per cent Zn across 13.16 m (estimated true thickness).

American Creek Resources Ltd. announced plans for 2,000 m of drilling at the Dunwell Mine project. Decade Resources Ltd. reported assay results from samples of volcanogenic massive sulphide boulders on the Goat property. Results included 541 g/t Ag, 2.41 per cent Pb, and 2.52 per cent Zn, and 395 g/t Ag, 5.51 per cent Pb, and 10.0 per cent Zn.

At its Rock and Roll project, Etruscus Resources Corp. intersected massive and semi-massive sulphides in a 400 m step out from the Black Dog silver-gold enriched VMS mineralization originally outlined by more than 11,000 m of drilling in the 1990s.

In late summer, Casa Minerals Inc. began an inaugural drilling program on its Pitman project. The company designates its priority target as the Golden Dragon quartz vein network.

Kutcho Copper Corp.’s Kutcho project is at the advanced stage, with a Probable mineral reserve of 10.4 Mt at 2.01 per cent Cu, 3.19 per cent Zn, 34.61 g/t Ag, and 0.37 g/t Au. In 2019, a new mineral resource estimate was announced at Measured + Indicated of 14.834 Mt grading 1.74 per cent Cu, 2.38 per cent Zn, 0.43 g/t Au, and 29 g/t Ag. Kutcho reported recoveries of up to 92.3 per cent for Cu and 84.2 per cent for Zn from metallurgical testing using composites representing a range of proposed process plant feed material. In September, Kutcho entered the environmental assessment and permitting process by submitting a project description to the British Columbia Environmental Assessment Office.

At the Surprise Creek property, Mountain Boy Minerals Ltd. reported assays from the Grunwald zone assaying up to 6.1 g/t Au and 196 g/t Ag as well as base metal values of up to 0.11 per cent Cu, 1.49 per cent Pb, and 15.1 per cent Zn. Samples from an extension of the Ataman base metal-barite zone returned assays of up to 0.3 per cent Cu, 5.46 per cent Pb, 1.24 per cent Zn, 147g/t Ag and 1.04 g/t Au. As well, the discovery of two new zones was reported with samples returning up to 17.3 per cent Pb, 6.45 per cent Zn, and 126 g/t Ag.

In mid-September, Pretium Resources Inc. reported that approximately 15,300 m (combined) had been drilled on volcanogenic massive sulphide targets at the A6 and Canoe zones and at an intrusion-related gold system at the Koopa zone for the Bowser Regional project. Drilling was to continue until the end of September.

Ni-Cu-Co-precious metal projects

Garibaldi Resources Corp. continued to drill at its Nickel Mountain project. Drilling was focused on building out the five known mineralized zones outlined by 46 holes drilled during 2017 and 2018. High grade results continued to be reported including 18.2 m of 7.04 per cent Ni, 3.81 per cent Cu, 0.19 per cent Co, 1.27 g/t Pt, 2.69 g/t Pd, 0.68 g/t Au and 7.65 g/t Ag within a broader intersection of 86.5 m averaging 1.88 per cent Ni, 1.32 per cent Cu, 0.05 per cent Co, 0.52 g/t Pt, 1.08 g/t Pd, 0.35 g/t Au and 3.55 g/t Ag (true width estimated at 69.2 m).

Coal projects

Allegiance Coal Limited continued to move its Tenas project forward. Environmental monitoring continued, and in June the company received a section 11 order from the Environmental Assessment Office of the Province of British Columbia. The order defines the environmental assessment process that ultimately leads to filing an application for an environmental assessment certificate, and then permits to mine. The company also undertook a 40-hole drill program consisting of both sonic and rotary drilling to collect data for geotechnical and geochemical analysis relevant to the environmental impact assessment and mine plan.

Industrial mineral projects

Durango Resources Inc. completed mapping and sampling at its Mayner’s Fortune project. The work discovered three additional massive limestone showings measuring approximately 100 m by 200 m, 50 m by 100 m and 50 m by 100 m.

Northeast and North Central Regions

Precious metal projects

New Gold Inc. continued environmental assessment work, on-site drilling, and other mine development activities on its Blackwater Gold project. Proven and Probable reserves are 344.4 Mt at 0.74 g/t Au and 5.50 g/t Ag. As proposed, Blackwater would be a 60,000 tpd operation with a 17-year mine life.

Benchmark Metals Inc. planned 3,000 m of drilling on its Lawyers gold and silver epithermal project, looking to extend mineralized zones including the Cliff Creek, Duke’s Ridge, Phoenix, AGB and Marmot. With the exception of Marmot, all zones are considered part of the same system. Results from the Cliff Creek zone included 11.73 g/t Au and 476 g/t Ag across 4.4 m, within 2.18 g/t Au and 85.36 g/t Ag across 26.75 m. The lower-grade envelope around the high-grade vein sets may indicate potential for a bulk tonnage resource. Exodus Mineral Exploration Ltd. followed up on its 2018 discovery of the AK orogenic gold prospect, about 10 km north of Prince George, with a program of trenching and sampling.

Cu-Mo, Cu-Au-Ag, and Mo (porphyry) projects

Although Centerra Gold Inc. received Mines Act approval for developing its Kemess Underground (KUG) mine earlier in 2018, the company announced a delay in November 2018 to concentrate resources on developing a project in the Kyrgyz Republic. KUG contains an estimated 246.6 Mt Indicated mineral resource at an average grade of 0.42 g/t Au, 0.22 per cent Cu and 1.75 g/t Ag, with an additional 21.6 Mt Inferred mineral resource at an average grade of 0.40 g/t Au, 0.22 per cent Cu and 1.70 g/t Ag. In 2019 Centerra completed 6,448 m of exploration drilling in a total of four holes in the Kemess area. One hole was on KUG, and three were on the Nugget prospect about 2 km to the west and thought to be a fault offset of the KUG deposit. In addition, more than 12,000 m of historic core (19 holes) were re-logged, with an additional 3,400 m planned for the fall of 2019.

About 1 km east of KUG is a second underground project, Kemess East (KE), which Centerra is considering for integrated development with KUG. KE has an Indicated resource of 113 Mt containing 954 Mlbs Cu, 1.7 Moz Au, and 7.1 Moz Ag. About 1 km east of the Kemess East (KE) area, Serengeti Resources Inc. completed a six-hole, 2,300 m drill program on its Atty project, thought to include a possible fault offset of the KE deposit.

Centerra explored extensively at its Mt. Milligan mine to expand reserves and investigate nearby prospects, and worked to resolve water supply problems. The company completed about 52 boreholes totalling about 20,000 m by way of infill and pit-expansion drilling, with another 8,000 m planned before the end of 2019. Brownfield and greenfield exploration programs comprised 9,900 m in 23 boreholes, of which 1,228 m in four boreholes were greenfield outside the mine lease area. An additional 6,000 m of brownfield drilling were planned for the fall of 2019. In addition, Centerra completed a 640 line km low altitude aeromagnetic survey and planned to complete a 32 line km brownfield IP survey by the end of the year.

On its Max property, west of Mt. Milligan, Centerra drilled 20 reverse circulation holes to bedrock totalling 536 m and planned a 50 line km IP survey. The company also completed drilling in four holes totalling 1,755 m on its Chuchi project north-northwest of Mt. Milligan, and a 713 line km low- altitude aeromagnetic survey.

Orestone Mining Corp. began drilling a total of 1,250 m in five holes on its Captain project south of the Mt. Milligan mine, focusing on the Admiral target, an Au- Cu-bearing potassic-sericite altered intrusive rock that had been intersected in previous drilling.

Kwanika Copper Corporation, (65 per cent Serengeti Resources Inc., 35 per cent POSCO Daewoo and Daewoo Minerals Canada) continued environmental baseline studies for the Kwanika project Central zone. Work on a pre-feasibility study continues for an integrated open pit and underground Central zone mine, with a projected life of 15 years at 15,000 tpd. The Central zone has a pit constrained Measured + Indicated resource of 104.6 Mt containing 540 Mlb Cu, 708 koz Au and 2,617 koz Ag. A further 118.9 Mt Measured + Indicated resource containing 784 Mlb Cu, 1.123 koz Au and 3,656 koz Ag is accessible by underground mining.

Serengeti also completed about 12 km of IP surveying, mapping and sampling on its Croy-Bloom prospect. IAMGOLD Corporation did about 80 km of IP surveying on its Dark Horse project, mostly along existing roads. Finlay Minerals Ltd. continued work on its Pil project, with mapping and hand trenching.

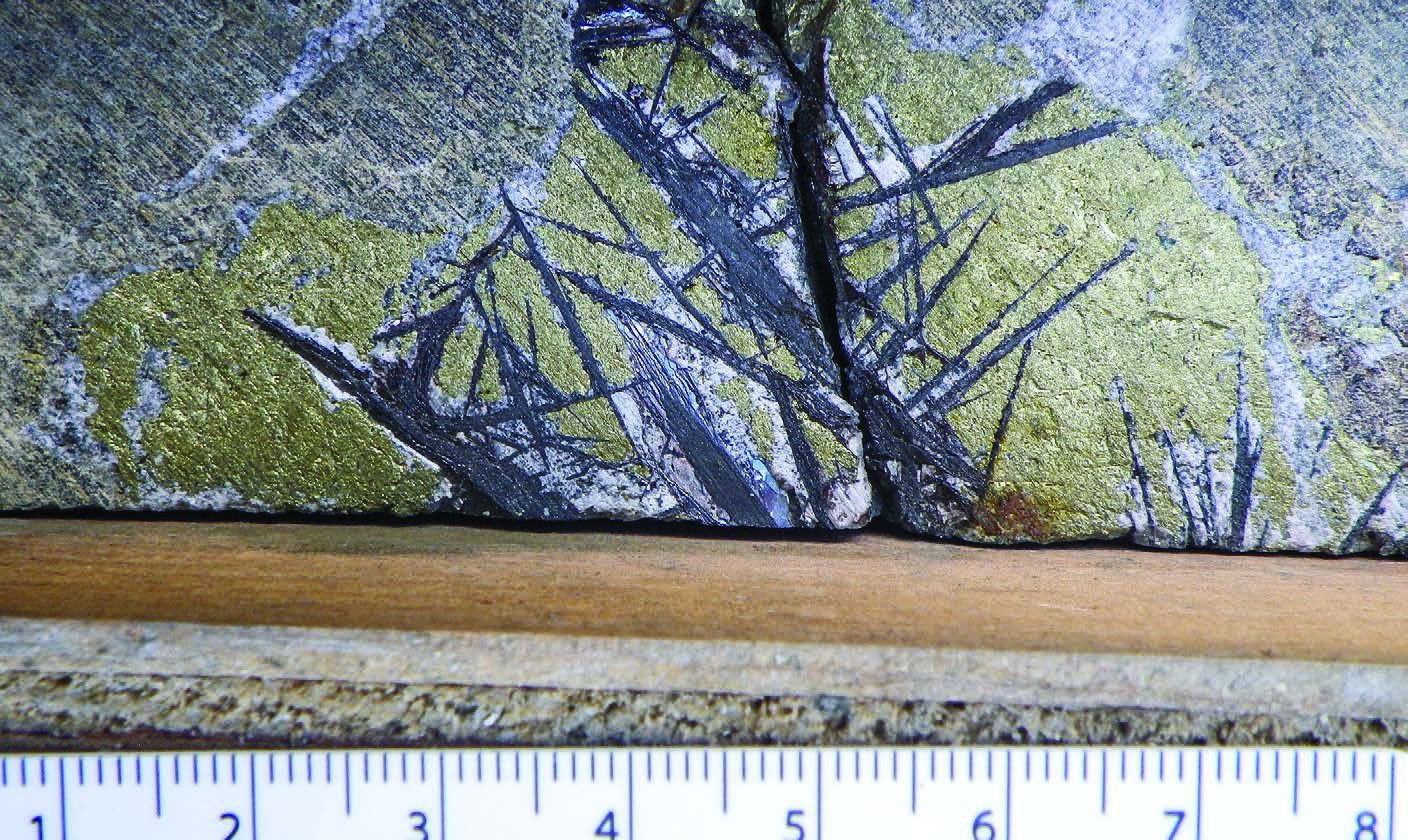

In April 2019, Sun Metals Corp. completed its acquisition of Lorraine Copper Corp., giving it 100 per cent ownership of the Stardust copper-gold skarn property. By the end of August, Sun Metals had completed more than 6,000 m of drilling on Stardust and planned for up to a further 9,000 m by the end of the year. The company also completed a large-loop EM survey and continued testing new areas and expanding the deposit. Drilling confirmed continuity of mineralization and showed that skarn alteration strengthens to the north, which is where the exploration focus will be maintained. The deposit has an Indicated resource (2018) of 985,000 t grading 1.43 per cent Cu, 0.62 per cent Zn, 1.59 g/t Au and 36.8 g/t Ag, and an additional Inferred resource of 1.985 Mt averaging 1.24 per cent Cu, 0.14 per cent Zn, 1.72 g/t Au and 30.5 g/t Ag, all at a 1.5 per cent copper-equivalent cutoff.

Tower Resources diamond drilled a total of 631 m in six holes on its Nechako Gold project. Previously, the company used reverse circulation drilling in this area of poor outcrop to sample glacial till and a define a down-ice dispersal train to locate drilling sites.

MGX Minerals Inc. completed about six holes totalling about 2,365 m in a 16-hole, 5,653 m program spanning 2018 and 2019 on its Fran property. Drilling intersected widespread potentially gold-bearing latestage sulphides in altered host rocks of its Bullion Alley zone.

Base and precious metal projects

ZincX Resources Corp. concentrated its 2019 drilling on the Cardiac Creek zone of its Akie project, emphasizing the initial five years of projected mine output. Geotechnical and hydrogeological data were collected from the same holes to confirm surface site selections. Four large-diameter HQ boreholes were completed, totaling 2,347 m. Hole A-19-151 intersected 9.8 per cent Zn+Pb and 15.5 g/t Ag across a true width of 16.37 m, including 10.74 per cent Zn+Pb and 16.74 g/t Ag across a true width of 14.24 m. The true width of the Cardiac Creek zone is estimated at 30.85 m. A 2018 preliminary economic assessment, based on a conventional underground mine and concentrator operation, reported a mine life of at least 18 years at a production rate of 4,000 tpd.

InZinc Mining Ltd. followed up its 2018 drilling program on its Indy project with an extensive soil geochemical survey aimed at defining and prioritizing future drill targets on what the company considers to be a vent-proximal SEDEX deposit.

Specialty metal projects

Following up on its 2018 drill program on its Aley niobium project, Taseko Mines Ltd. continued environmental monitoring and began product development and marketing initiatives. A pilot plant program was initiated, to build on bench-scale niobium flotation and converter processes and to provide product samples for marketing.

Defense Metals Corp. completed a 30 t bulk sample at its Wicheeda carbonatite project, and in June released a NI 43-101 report that set out, at a 1 per cent LREE cutoff, an inferred resource of 11.37 Mt grading 1.14 per cent Ce, 0.53 per cent La, 0.23 per cent Nd, 0.04 per cent Nb, 0.01 per cent Sm and 1.96 per cent LREE. In September, the company completed a 13-hole, 2,005 m drilling program, which left the deposit open to the north and west.

FPX Nickel Corp. reported bench-scale test results for metal extraction on the Baptiste deposit at its Decar project. The company is considering testing a 10,000 t bulk sample. A conventional flow sheet based on grinding, magnetic separation and flotation processes consistently produced clean nickel concentrates grading 63 per cent to 65 per cent Ni with significant improvements in recovery relative to previous testing. Byproduct iron ore concentrates graded 60 per cent to 65 per cent Fe.

Coal projects

Conuma Coal Resources Ltd. drilled a total of 22 holes at six sites on its Hermann project southeast of Tumbler Ridge and began work on a program of 36 geotechnical holes. In July the company applied to the Environmental Assessment Office to open the Hermann pit as a “satellite” to the Wolverine mine. If given approval, the Hermann pit would produce 1.5 to 3 Mt of coal per year and add up to seven years to the life of the wash plant at the Wolverine mine.

Conuma continued drilling on its Brule mine coal lease area and was planning in-pit drilling at the Wolverine mine to test possible expansion underground.

With Mines Act approval for its Murray River underground coal mine in place since 2018, HD Mining International Ltd. awaited an investment decision to move ahead. The proposed mine contains a Proven reserve estimated at 291 Mt of mineable coal.

Industrial mineral projects

The environmental assessment review and Mines Act permit process is underway for Graymont Western Canada’s Giscome lime production project. Initially, up to 600,000 t of limestone would be quarried annually, with the crushed stone moved by truck to vertical lime kilns near Giscome, and the product transported by existing rail lines to service mining and pulp and paper operations in northern British Columbia. Production is expected to start by about 2025.

Southeast Region

Precious metal projects

The Greenwood district continued to see activity from several companies in 2019. KG Exploration Inc. (Kinross Gold Corporation) continued exploring for base metal and epithermal gold mineralization on 27,346 ha optioned from Grizzly Discoveries Inc. Golden Dawn Minerals Inc. continued work near its Lexington, Golden Crown and Phoenix projects. GGX Gold Corp. drilled and trenched at its Gold Drop property, targeting a system of parallel high-grade epithermal veins.

In the Kootenays, Apex Resources Inc. started drilling at the Ore Hill project late in the year, targeting narrow, high-grade gold veins and breccias. Magnum Goldcorp Inc. planned a late drill program at the LH project. PJX Resources Inc. drilled at its Gold Shear property, targeting a geophysical anomaly below outcropping quartz veins where grab samples returned assays of 68 to 194 g/t Au.

Base and precious metal projects

SEDEX and associated polymetallic mineralization in Mesoproterozoic rocks continued to be targets in the East Kootenays. PJX Resources Inc. continued drilling magnetotelluric anomalies on the Vine property and intersected bedding-parallel massive sulphides consisting of mainly pyrrhotite with minor chalcopyrite, galena and sphalerite. The company also carried out further sampling at its SOUTHEAST REGION Parker Copper project. Teck Resources Limited continued drilling at the Sweet Spot project, and Highway 50 Gold Corp. began drilling at the Monroe project late in the year. Eagle Plains Resources Ltd., conducted magnetotelluric surveys and did additional work at its Vulcan project. Braveheart Resources Inc. drilled at its newly acquired Bul River mine property.

In the West Kootenays, Taranis Resources Inc. continued exploring the Thor property for gold and stratiform base metals, and continued with permitting for a bulk sample to characterize the ore. Klondike Silver Corp. continued underground drilling at the Silvana project along trend from historic mineralization. Grab sampling in historic underground workings yielded results of up to 11,250 g/t Ag, along with 23.4 per cent Pb and 32.6 per cent Zn. Rokmaster Resources Corp. continued mapping and sampling at the Duncan project for stratiform replacement zinc-lead.

Industrial mineral projects

HCA Mountain Minerals (Moberly) Ltd. drilled at its Moberly Silica mine to redefine the resource. In the West Kootenay, Eagle Graphite Incorporated was awarded a grant to study the use of graphite from the Black Crystal project in battery anodes.

Coal projects

At the Fording River, Greenhills, Elkview and Line Creek mines, Teck Coal Ltd. continued exploration drilling in active pits, with continued exploration in their expansion areas.

Several coal projects are in various stages of environmental assessment. North Coal Limited (formerly CanAus Coal Ltd.) continued drilling and coal quality testing on potential expansion areas at its Michel Creek project and last year submitted an updated project description to the British Columbia Environmental Assessment Office. Jameson Resources Limited continued environmental baseline work for its Crown Mountain project, which entered the pre-application stage of environmental assessment in October, 2014. Pacific American Coal Ltd. continued work at the Elko project, which is in early stages of exploration.

South Central and Southwest Regions

Precious metal projects

Barkerville Gold Mines Ltd. continued drilling in 2019 at the Cariboo Gold project, with 20,000 m at Island Mountain and 40,000 m planned on Barkerville Mountain. Barkerville released a preliminary economic assessment based on up to a 4,000 tpd underground operation with an 11-year life. Total ore mined would be 14.7 Mt at an average diluted grade of 4.52 g/t Au. After-tax net present value at a 5 per cent discount rate is estimated at $402 million, and after tax internal rate of return at 28 per cent. The company also initiated the British Columbia Environmental Assessment process, with a project description. In September, Osisko Gold Royalties Ltd. entered an agreement to acquire Barkerville. The deal values Barkerville’s equity at $338 million.

Westhaven Ventures Inc. continued to intersect high-grade epithermal gold veins at Shovelnose in 2019. A third vein zone, below and northeast of the first and second zones, gave a 7.11 m intersection grading 9.42 g/t Au and 69.36 g/t Ag. The second vein zone included an intersection of 52.22 m of 5.13 g/t Au and 17.32 g/t Ag. The company also undertook soil geochemistry, prospecting and geological mapping on the property. After Westhaven Ventures’ work at Shovelnose showed signs of success in 2018, Talisker Resources Ltd. acquired tenure for much of the area underlain by Spences Bridge Group rocks and conducted a large reconnaissance program on the Spences Bridge project in 2019.

Avino Silver and Gold Mines Ltd. had a 28,000 to 30,000 m two-phase drill program at the Bralorne mine that began in 2018 and extended through 2019. It included an underexplored area called the NorthEast block. Reporting gold-bearing veins in 27 of 35 holes, the company considers that the area has greater potential than previously recognized.

Privateer Gold Ltd. drilled at Surespan in the Zeballos gold camp, planning to complete about 3,000 m in 10 to 15 holes by the end of 2019. Some published intersections are consistent with narrow gold vein mineralization like that mined historically in the Zeballos Camp and include: 1,386.5 g/t Au across 0.3 m in the recently discovered 88 vein; 5.81 g/t Au across 7.12 m in a 50 m step out from the Prident mine; and 24.20 g/t Au across 0.55 m in an 80 m step out from the White Star mine. Privateer is a private company working mainly on Crown-granted mineral claims, and is not obligated to release results. They acquired additional mineral Crown grants (Central Zeballos property) from CanAlaska Uranium Ltd.

Engold Mine Ltd. drilled its Lac La Hache project in early 2019, stepping out at the Aurizon target. Initial results extended narrow quartz-carbonate gold veins along strike. Engold resumed drilling later in the year and carried out soil surveys on four target areas.

At the Ladner Gold project, New Carolin Gold Corp. mobilized for 1,000 m of underground drilling on the footprint of the Carolin Mine. The fall program also included mapping and sampling to generate nearsurface targets.

New Destiny Mining Corp. drilled at the Treasure Mountain Silver project. The first holes were to test a porphyry copper-gold target (Superior), the site of recent trenching and historical trenches and adits.

In 2019, Academy Metals Inc. (formerly Unity Metals Corp.) explored several properties adjacent to the Phillips Arm gold camp, including Margurete and Hewitt Point. Packsack drill and outcrop samples produced several results of greater than 10 g/t Au. Packsack drill results included a 2 m core sample grading 6.18 g/t Au and 8.1 g/t Ag and a 0.38 m sample grading 8.62 g/t Au and 3.8 g/t Ag.

Blue Lagoon Resources Inc. collected rock and soil samples at the Pellaire project, and carried out a ground magnetometer survey. Recent samples from a 1998-1999 bulk sample stockpile averaged 6.24 g/t Au and 25.95 g/t Ag.

Spanish Mountain Gold Ltd. continued metallurgical testing and investigating alternatives for developing the Spanish Mountain project, including efforts to lower initial capital costs and refine a pit shell to isolate higher grades.

Bayhorse Silver Inc. optioned the Brandywine past producer and began compiling historical data and preliminary work at the site, including re-sampling of 2010 drill core. In 1977-78 about 10,000 t of ore from Brandywine yielded 23,000 oz Ag and 11,000 oz Au, with Pb, Zn and Cu co-products.

Tempus Resources Limited is proposing to acquire the Blackdome- Elizabeth gold project from Skeena Resources Limited. In addition to a due diligence review, Tempus conducted soil geochemistry across target areas.

Kootenay Zinc Corp. optioned the Angus property from Longford Capital Corp. Reconnaissance work revealed new mineralization. The area has been explored intermittently since at least 1964, with samples returning assays up to 13 g/t Au.

Canarc Resource Corp., which optioned the Princeton Gold property at the end of 2018, completed an airborne survey at the beginning of 2019.

Pinnacle North Gold Corp. optioned the Donna project from Eagle Plains Resources Ltd. and drilled one hole.

Cu-Mo, Cu-Au-Ag, Mo (porphyry) projects

Drilling continued at Copper Mountain in 2019 in the search for resources close to existing reserves. Following drilling at nearby Ingerbelle in 2017-2018, Copper Mountain Mining Corporation converted resulting resources to reserves in 2019, extending mine life by an estimated 12 years.

New Gold Inc. has been drilling deep mineralization at its New Afton Mine in the westward extension of the SLC zone and in the D-zone target down plunge of the C-zone reserves. The C-zone itself is expected to extend mine life to 2030. The company also reported surface geophysics (IP) and geochemistry to identify drill targets along the Cherry Creek trend within 3 km WNW of the New Afton Mill.

Teck Resources Limited is evaluating an extension project at Highland Valley Copper. The HVC 2040 project could extend mine life to 2040 or beyond. Pre-feasibility level engineering suggests the project is viable and it has entered the environmental assessment process. Separately, the Bethlehem Pit extension now has a Mines Act permit. In August, the British Columbia Environmental Assessment Office declined to designate the Bethlehem extension reviewable.

In 2018, NorthIsle Copper and Gold Inc. optioned the Pemberton Hills area of its North Island property to Freeport-McMoRan Mineral Properties Canada Inc. Work in 2019 included IP, geological mapping, geochemistry and clay studies to refine fall and winter drill targets.

During mapping and sampling reconnaissance work, ArcWest Exploration Inc. sampled up to 21.2 g/t Au and 15 g/t Ag in an apparent epithermal zone at its Teeta Creek project, primarily known as a porphyry Cu-Mo prospect. Preliminary radiometric dating of molybdenite suggests a Miocene age of mineralization.

Also investigating Miocene porphyrystyle mineralization, Tocvan Ventures Corp. collected 48 grab samples at the Rogers Creek project, returning up to 2.41 g/t Au. An IP survey is permitted.

Karmamount Mineral Exploration Inc. carried out an IP survey at its Yreka project to test possible porphyry stockwork mineralization west of the Yreka past Cu-Au-Ag producer. Lines also extended over the known Cu-Au skarn mineralization.

Dunnedin Ventures Inc. reported rock geochemistry results for its MPD project, including 0.89 per cent Cu across 46 m and 3.26 g/t Au across 7.0 m in resampling of historic trenches. Other work included mapping, prospecting, soil geochemistry and drilling. MPD is a consolidation of the Man, Prime and Dillard properties.

Troubadour Resources Inc. carried out mapping, prospecting, sampling and drilling at its Amarillo Cu porphyry project in 2019, following drilling at the end of 2018.

Pacific Ridge Exploration Ltd. drilled at the Spius project in 2019. All four holes (1,087 m in total) intersected porphyry-style alteration and mineralization. Although sub-economic, Cu concentrations increased with depth in two of the holes, which suggested a deeper target to the company.

Jiulian Resources Inc. drilled more than 4,000 m in nine holes at the Big Kidd project in 2019. As at Spius, results confirmed porphyry-style alteration and mineralization and the company is considering deeper drilling.

At Mackenzie Copper, Carube Copper Corp. reported mapping and sampling on two of three known Cu trends.

The combined Rateria-West Valley project was active in 2019. Happy Creek Minerals Ltd. has defined new porphyry Cu targets at West Valley and followed up with mapping, sampling and IP surveying.

Base and precious metal projects

Imperial Metals Corporation and partners are following their 2018 deep drilling program at Ruddock Creek with an 8,000 m program focused on a westward extension of the deposit. Partners in the project are Mitsui Mining and Smelting Co. Ltd. (30 per cent), Itochu Corporation (20 per cent), and Japan Oil, Gas and Metals National Corporation (2 per cent).

In 2019, Nicola Mining Inc. drilled at the New Craigmont Cu skarn project. Among results from the first three holes were 44 m of 0.56 per cent Cu in orebody 3, and 84 m of 0.34 per cent Cu in a 50 m westward step out.

The British Columbia Environmental Assessment Office terminated Yellowhead Mining Inc.’s Harper Creek copper project assessment in 2018. However in early 2019, Taseko Mines Limited acquired Yellowhead, renamed the project Yellowhead and is evaluating advancing it.

Surge Exploration Inc. trenched at its Hedge Hog project, following up in-soil geochemistry anomalies from a 2018 survey. The primary target is VMS mineralization as suggested by sulphide boulders discovered in the 1990s. Of 29 excavations, 25 reached bedrock.

Ni-Cu-Co-precious metal projects

The Iron Lake project is a Cu-Au-PtPd-Co-Ni target in mafic and ultramafic intrusive rocks. Eastfield Resources Ltd. reported carrying out an IP survey. The property is subject to an option agreement with GK Resources Ltd.

Tungsten projects

Happy Creek Minerals Ltd. drilled 372.5 m in two holes near the Nightcrawler zone at its Fox Tungsten project. Results include 6.3 m 0.43 per cent WO3 and 4 m of 0.29 per cent WO3 at the Nightcrawler zone. Fox is a skarn prospect with 582,400 t of 0.826 per cent WO3 (Indicated) and 565,400 t of 1.231 per cent WO3 (Inferred) in three zones.

Cobalt, base and precious metal projects

Blackstone Minerals Ltd.’s work at the BC Cobalt project included soil and stream-sediment geochemistry and mapping.

Specialty metal projects

Delrey Metals Corp. flew an airborne survey and identified a large magnetic anomaly at its Peneece Fe-Ti-V project. Delrey increased the size of the property to cover the anomaly. Previously called Wigwam Magnetite, this prospect comprises a large, low grade (5 to 10 per cent) titaniferous magnetite deposit.

Public Geoscience 2018-2019

Celebrating its 125th anniversary in 2020, the British Columbia Geological Survey (BCGS) is the oldest scientific organization in the province. The Survey conducts research to establish the geological evolution and mineral resources of the province. It partners with federal, provincial and territorial geoscience agencies and other national and international organizations. Drawing on continuously advancing concepts and technologies, the Survey creates knowledge to guide societal decisions centred on the Earth sciences, connecting government, the minerals industry and communities to the province’s geology and mineral resources. The information provided by the Survey is used for effective mineral exploration, sound land use management and responsible governance, benefitting decisions that balance the economy, the environment and community interests. It delivers reports, maps and databases, which can be freely accessed through MapPlace 2, the BCGS geospatial web service.

The largest field project in 2019 was centred on the northern Hogem Batholith and adjacent rocks of the Takla and Cache Creek groups. In its second year, the project will provide a modern understanding on the controls of diverse mineralization types in the region, and includes both bedrock and surficial mapping. An ancillary project evaluated the production of digital elevation models from drone-mounted optical systems, and how these models can be used to support field mapping and exploration.

North of the Hogem Batholith, the second year of a TGI-5 partnership with the Geological Survey of Canada was completed. This study, designed to establish the geological framework and geochronology of the Polaris ultramafic intrusion, will be integrated with work on the Tulameen ultramafic body to create a new model for Ni-Cu-PGE ore-forming processes in these Alaskan-type intrusions.

The BCGS also partnered with the Bradshaw Research Initiative for Minerals and Mining at the University of British Columbia on a project that examines the feasibility of sequestering carbon dioxide through reactions with alteration minerals in serpentinized ultramafic rocks. Field activities centered on the Trembleur ultramafic unit in the Cache Creek terrane and will be followed by province-wide delineation of serpentinized ultramafic bodies that could potentially sequester carbon dioxide.

In the Golden Triangle of northwestern British Columbia, a new multi year mapping project was started to further refine the stratigraphy of the Hazelton Group and associated mineralization near Kitsault. Also in the northwest, field work in the Dease Lake area examined critical sections to support a report summarizing three years of mapping in an area rich in mineral potential.

A pilot project was undertaken in northern Vancouver Island to test panned stream-sediment and water geochemistry combined with Pb isotopic compositions to explore for metallic deposits in glaciated terranes. A depth-to-bedrock study was started along the Quesnel arc in the largely till-covered area between the Mount Milligan and Mount Polley porphyry Cu deposits, using surface and subsurface data from assessment reports, water wells, and bedrock and surficial maps.

The BCGS houses, maintains, and regularly updates numerous databases, including MINFILE, COALFILE, Property File and the Assessment Reports Indexing System (ARIS). MINFILE documents more than 14,900 metallic mineral, industrial mineral and coal occurrences. COALFILE includes a collection of 1,020 coal assessment reports. Property File has more than 82,000 reports and maps documenting exploration activity in British Columbia since the late 1800s. ARIS has more than 37,400 mineral exploration assessment reports, representing about $2.8 billion of exploration expenditures.

Traditionally, data in assessment reports have been embedded in non-digital electronic files (e.g. .PDF) making them difficult to extract and use. The BCGS has embarked on a program to encourage digital submission of ARIS data using digital data files such as spreadsheets, databases, maps and grids. Explorationists will benefit because digital data can be easily retrieved, integrated, and recast for specific needs. Digital submission will also enable the Survey to better maintain province-wide databases and create derivative products that use past results to guide future exploration.

The BCGS continues to maintain geochemical databases with multi element analyses from rock, till, stream- and lake-sediment, water and coal ash samples. The databases include more than five million determinations from about 86,000 samples. A compilation of more than 150,000 ice-flow indicators digitally captured from published and unpublished surficial geology, terrain, glacial features and bedrock geology maps is available. In addition, the BCGS is developing a new geochronological database and updating the lithogeochemical and RGS databases. The BCGS offers province-wide integrated digital coverage of bedrock geology, including all details from compilation of field mapping at scales from 1:50,000 to 1:250,000. The B.C. bedrock geology regularly integrates new mapping from field geologists.

Along with the BCGS and the GSC, Geoscience BC, a not-for-profit, non government geoscience organization funded by provincial government grants, also distributes geoscience data in British Columbia. Geoscience BC is industry-led, and supports mineral and oil and gas investment to British Columbia through the funding and delivery of geoscience data produced by third parties. Geoscience BC awards contracts for large geophysical and geochemical programs and provides grants to universities and consultants for targeted geoscience projects typically generated through requests for proposals. Geoscience BC is governed by a volunteer board of directors and receives technical direction from volunteer technical advisory committees (mineral exploration, oil and gas, and geothermal) whose membership is largely drawn from the exploration industry.