Northwestern British Columbia is a large, diverse area with a large, diverse mineralogy. Sometimes referred to as the Golden Triangle, the region is host to 39 exploration and development projects, according to the B.C. Mineral Development Office. Three of those projects are Seabridge Gold Inc.’s KSM, Pretium Resources Inc.’s Brucejack and Alloycorp Mining Inc.’s Avanti Kitsault.

The big picture

Tom Schroeter, a longtime senior B.C. government geologist and former president of Fjordland Exploration Inc., says there are three main types of deposits in the Golden Triangle. “There are high-grade vein deposits, larger porphyry copper-gold deposits and volcanogenic massive sulphide deposits,” says Schroeter. “There are industrial minerals, too. It’s a very fertile region.”

As rich as it is, the Golden Triangle doesn’t include the Avanti Kitsault porphyry molybdenum deposit, which lies about 75 kilometres outside the unofficial boundaries of the region.

Schroeter says the key to development of the region has always been adequate infrastructure, because the region is rugged and remote. “The Golden Triangle has gradually been opened up by railroads, airplanes, helicopters, extension of BC Hydro line and roads,” he explains. “But we still need road access off Highway 37.”

According to Schroeter, the region has excellent geology: “We estimate there’s more than $15 billion of reserves in the ground.” In addition, recent melting of snow and ice has revealed new deposits in the region. “However, only minimal surveys and mapping have been undertaken so far,” he says. “Government and industry need to work together to correct this.”

Schroeter says northwestern B.C. offers many opportunities, but also many challenges. In addition to the harsh climate and geography, which means many new roads and bridges will be needed, challenges include the high cost of power, the need to increase the capacity of the Port of Stewart, the need for upgraded telecommunications, the high cost of drilling and the lack of skilled labour in the region.

Regarding the three projects in question, Rob McLeod, president and CEO of IDM Mining Ltd., says KSM and Valley of the Kings are two of the largest undeveloped gold deposits in the world, with significant concentrations of copper and silver. “Valley of the Kings, in particular, hosts some of the highest gold and silver grades on a worldwide basis, and could become one of the richest mines in the world,” McLeod says. “In the case of Kitsault, B.C. mines have long been an important worldwide source for molybdenum, a metal used in numerous steel alloys, particularly natural gas pipelines. All three projects would have a significant impact on the overall economy of the province, particularly for the rural residents in northwest B.C.”

McLeod says all three projects have near-term production potential, as they are all advanced in the permitting and feasibility processes. “Kitsault has funding in place to commence construction, and KSM and Valley of the Kings are not far behind,” he says. “Kitsault has an excellent location near existing infrastructure, since it is a past producer. The biggest challenges for the adjacent KSM and Valley of the Kings is unquestionably location and weather – huge annual snowfalls, mountains and glaciers. Made-in-B.C. ingenuity will be required to overcome those challenges.”

The projects are expected to provide a big boost to both the regional and provincial economies. “They would all be large mines, each requiring hundreds of millions to billions of dollars to construct, with similar figures for annual gross cash flow,” says McLeod. “Each project by itself could represent single-digit increases to the provincial GDP.”

In addition, McLeod says, the high-paying resource jobs that would come with the projects would provide a big boost to the local economy, with Red Chris and Huckleberry mines the only currently producing operations in the northwest. !

KSM (Kerr-Sulphurets-Mitchell) Project

Seabridge Gold Inc.’s KSM project is one of the largest undeveloped gold projects in the world. Proven and probable reserves total 38.2 million ounces of gold and 9.9 billion pounds of copper.

Federal Minister of the Environment Leona Aglukkaq recently issued her environmental assessment decision statement endorsing the project, which is consistent with the Province of British Columbia’s earlier approval of KSM.

In an announcement, Seabridge Gold chairman and CEO Rudi Fronk said, “With this positive decision, the Canadian government has concluded its lengthy and rigorous environmental assessment process for the KSM project, which began in 2009.”

Exploration continues at KSM . In June 2014, a new exploration program began to expand the Deep Kerr deposit and to search for additional higher-grade deposits. In September 2014, the company announced it had discovered another higher-grade deposit beneath the Iron Cap deposit.

In November 2014, Seabridge reported the complete drill results from its 2014 exploration drilling campaign at Deep Kerr. A total of 12,900 metres in 13 core holes expanded the known dimensions of the deposit along strike to the north and south as well as at depth. Drilling also confirmed the geological and resource models developed after the 2013 discovery program.

In an announcement, Seabridge said it is “highly confident” that the 2014 results will support a substantial increase in the Deep Kerr inferred resource, which currently stands at 515 million tonnes grading 0.53 per cent copper and 0.36 grams per tonne gold. A new resource estimate is expected in the first quarter of 2015.

Valley of the Kings

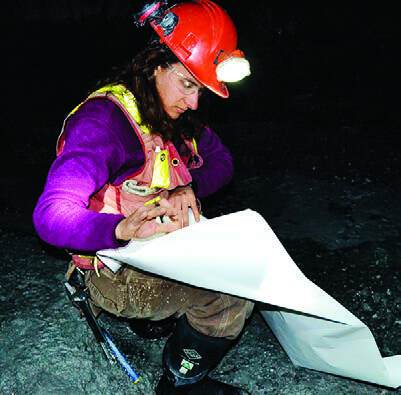

Pretium Resources Inc. has the 100-percent-owned, advanced-stage Brucejack project located 65 kilometres north of Stewart, B.C. The focus of Brucejack is the Valley of the Kings, which is made up of high-grade visible gold stringers within a lower-grade gold-quartz stockwork system.

A feasibility study completed in June 2014 has outlined proven and probable mineral reserves in the Valley of the Kings of 6.9 million ounces of gold (13.6 million tonnes grading 15.7 grams per tonne gold). The deposit remains open in all directions. According to the study, the mine will use long-hole stoping and cemented paste backfill. Stopes will be mined using a combination of longitudinal and transverse mining, depending on zone width and orientation. Cemented paste tailings will be prepared in a paste plant located on surface near the mill and then pumped underground for distribution to the stopes.

Pretium recently reported the remaining assay results from infill surface drilling in the Valley of the Kings, which targeted the deeper portion of the 2013 Mineral Resource estimate block model. Selected drill highlights include: hole SU-644-W1 intersected 13.81 grams of gold per tonne over 22.1 metres, including 1,085 grams of gold uncut over 0.5 metres; and hole SU-644-W2 intersected 125.35 grams of gold per tonne over 4.45 metres, including 1,620 grams of gold uncut over 0.5 metres and 2,930 grams of gold uncut over 0.5 metres.

VP of corporate relations Michelle Romero says permitting is underway for an underground mine at Brucejack, with commercial production of a 2,700-tonnes-per-day underground mine targeted to begin in 2017. The mine is expected to have an 18-year life.

Avanti Kitsault

Alloycorp Mining Inc. (formerly Avanti Mining Inc.) says its goal is to become the unique supplier of steel alloy metals. The cornerstone of its strategy is the development of its Avanti Kitsault molybdenum project. Once the project is developed, Alloycorp will look to grow through the acquisition of other assets that produce steel alloys. Alloycorp hopes to become a top-four primary molybdenum producer by 2017.

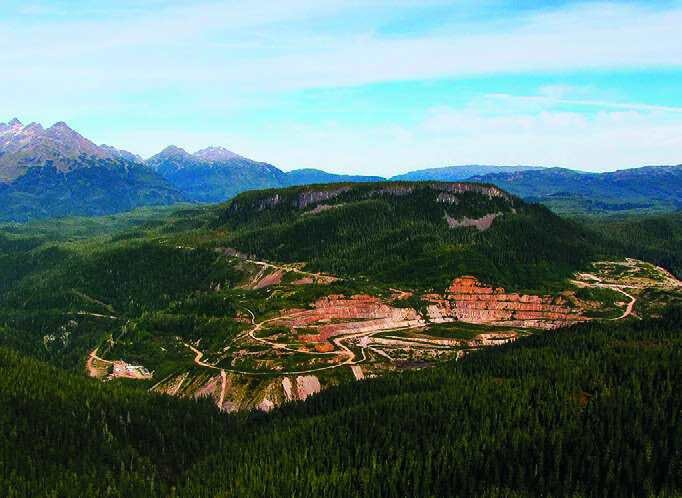

Avanti Kitsault is located 120 kilometres north of Terrace. The mine plan is for a conventional truck-and-shovel, open-pit operation. According to the plan, the mine will operate 365 days per year, with enough materials stockpiled at the crusher and coarse ore stockpile to accommodate mine downtime during the harsh northern winter.

Alloycorp has off-take agreements for up to 70 per cent of total mine production. In June 2013, the company entered into an offtake agreement with ThyssenKrupp Metallurgical Products GmbH for one-half of total molybdenum production at Avanti Kitsault over the life of the mine. Molybdenum will be delivered to ThyssenKrupp in the form of molybdenum oxide after it has been processed at Molymet’s facilities in Chile and Belgium. And in April 2014, Alloycorp entered into an off-take agreement with SeAH M&S Corp. for up to 4,200 tonnes of molybdenum concentrate – about one-fifth of total molybdenum production – annually for 12 years.

Avanti Kitsault is in the pre-construction stage. “Earth-moving is taking place now, with major construction slated to begin in March 2015,” says president and CEO Gordon Bogden. The construction project will entail preparing the camp site, the plant, the mill and the tailings pond. Construction is expected to be completed in the first quarter of 2017, with full mine production beginning soon afterward.

According to Bogden, the project is moving forward satisfactorily. “When it is operating, Avanti Kitsault will be one of the lowest-cost molybdenum mines in the world,” he says. “The price of molybdenum is only about $9 per pound today, but it is expected to rise to around $15 to $17 per pound.”

Bogden says the company’s name was changed in November 2014 in order to reflect the direction of the company’s business. “We’re not like other miners in the region,” he says. “As a key supplier in the production of stainless steel, Avanti Kitsault is a vital component of the global industrial supply chain. With continued growth expected in the U.S. and general economic improvement globally, we are well positioned to capture the potential upside through growing industrial production.”